Abstract: As more companies embrace the permanent remote work option let us note that there are a few issues yet to resolve. After tracking months of headlines and trend pieces I’ve assembled what I think are the best, within the framework of the 1) urban/rural and 2) organizational technical and cultural effects for better planning. For example, residential and commercial rents are falling rapidly in large cities home to some of the world’s largest financial service and tech companies.

If this is permanent or temporary and to what extent could make every remote policy decision strategic to growth and profitability.It is clear the digital age we’re entering with gusto is about to transform the very essence of modern life, from cities to organizations. There will be new benefactors, some unforeseen gaps between expectations and realities and some left behind.

As we follow the yellow brick road let’s be mindful of the cities and places and organizational challenges ahead of us. How we address those challenges will have a substantial impact on our growth, productivity and profitability.

We blogged about remote first last week, as NetBeez planned the GA release of its new remote worker network monitoring solution. The reception to remote first has been mixed for obvious reasons, from the debate around the benefits of a centralized HQ model to the ongoing impacts these HQs have on the cities where they operate. The core nature of cities and organizations will be transformed. So where do we go from here?

Outcomes Will Vary

Let’s discuss outcomes when it comes to HQ locations, in order to understand the short and long term impacts of remote first for which cities you operate in. Then we’ll shift to the greater impact of the network on remote user productivity.

The benefits of flexibility, reduced operations expenses and access to skills are pretty well understood and powerful, especially for financial service and technology companies as well as many types of startups. (See Chris Herd’s brilliant TwitterFest mentioned last week – and feel free to weigh in). For the cities the impacts are almost binary. They will either lose or gain higher wage digital workers.

The HQ exodus has already gathered considerable steam (Business Insider):

Following the pandemic, more than half of Americans want to continue working remotely, while two-thirds of companies may render their current work-from-home policies permanent.

A Tale of Two Cities and of Many Cities

Remote work (or #WFH) can accelerate the distribution of tech incomes into smaller cities, suburbs and rural areas faster than more efficiently than the most well-intentioned government programs. Remote access becomes the new Yellow Brick Road to areas with lower costs, outstanding services, first rate internet access and great lifestyle options.

From Seattle KOMO News, A Tale of Two Cities:

“In some sense, the pandemic has brought a tale of two cities. We’re seeing such a dramatic change to Seattle as a lot of the officer workers are no longer coming to downtown and spending as much money as they were prior to the pandemic. Whereas, there’s a wealth of opportunity in these distribution centers in the neighboring cities that are still employing people,” said Shulman.

In the short term the issue is whether these departures from cities like NYC and San Francisco are temporary or permanent as reported in Vanity Fair “Tech Workers Are Never Going Back to the Office”):

As Brooklyn and San Francisco empty out, Los Angeles, Palm Springs, and Miami are booming thanks in part to tech workers’ hunger for space and amenities. And the shift might be permanent.

Zillow, for example, had leased some of Seattle’s most expensive real estate before surveying employees about their preferences (The Information) and then shifting to a more remote-friendly posture:

The company’s plans seem to fit with what most employees say they want. A survey this month found that just 2% of Zillow’s employees wanted to come back to the office five days a week. Nearly 60% wanted to work remotely at least four days a week, or all the time.

It is clear that in tech there is a renewed movement to remote work and fair speculation that many employees will prefer working from a location of their own choosing. After all, if you could live anywhere would it be a short commute to a company HQ? Yes for some, but for most employees there are a long list of competing attractions, from family to mountains, beaches or exotic offshore locations.

The Benefits of Traffic and Pollution

The long hour commute on slow-moving freeways -with all of the negative environmental and infrastructure impacts- could quickly become a thing of the past, especially in primary HQ cities with high proportions of digital workers.

Yet there are unintended consequences and some urban leaders have already done the math in terms of less density, less revenue and shrinking budgets under the strain of COVID-19 lock down effects. Some transit interests in the Bay Area were already (pre-Covid) considering higher tax levies to offset loss of ridership, fare evasion and expansion into new locations. Some of the initial negative reaction to remote first is coming from the digital-heavy Silicon Valley:

Bay Area lawmakers said a work-from-home mandate would hurt small businesses located around large employers, drain vitality from downtowns and diminish transit use. The requirements would also fall heavily on low-wage workers who typically must report to work to cook, clean, build or serve customers.

– Make remote work permanent? No way, say Bay Area leaders – San Jose Mercury News 10/16/2020

Costs and Culture More Important Than Ever

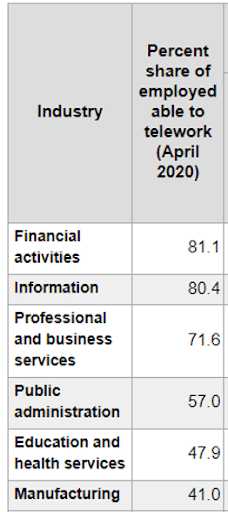

Cities with high costs and declining services can lose more tax income unless they raise taxes from those who cannot easily leave. Does your organization want that exposure? Many cities had financial difficulties before the pandemic. And the industries which are the easiest to adapt to “remote first” are financial services and tech, according to a 2020 report from the Bureau of Labor Statistics. The cities where these industries are the biggest contributors to economic activity include New York City and San Francisco. San Francisco (once one of the world’s most most desirable cities) has seen a sudden, deep drop in commercial office and residential rents:

In addition to 5.6 million square feet of directly vacant, un-leased office space spread across the city, which is up from around 3.7 million square feet of un-leased space at the same time last year, there is now 6.2 million square feet of office space in San Francisco which has been leased but is sitting vacant and actively seeking a subletter, which is up from 770,000 square feet of sublet-able space at the same time last year, according to Cushman & Wakefield.

– Nearly 12 Million Square Feet of Vacant Office Space in S.F., Socketsite 10/14/2020

To put this in perspective, the office vacancies in San Francisco as of October 2020 are equivalent to almost nine empty Salesforce Towers. This in a city that has been booming for decades and yet now experiencing rising rates of property crime and homelessness.

Disruptive Shifts and Sunk Costs

The remote first model will impact funding for city services, beyond reductions in traffic and tax receipts. Cities cannot redeploy to lower cost areas nor can they easily scale services up or down in response to economic changes. They have tons of sunk costs (roads, for example) and long term employee contracts.

A prescient (2017) report in Governing exposed the problem with remote work and long term transit investments:

But one thing is changing: More people aren’t going into an office at all. Americans primarily working from home recorded its largest ever year-over-year increase in 2016, climbing to 5 percent of the workforce. Using the Census estimates, we compared each metro area’s average share of workers telecommuting in 2015 and 2016 with averages for 2006 and 2007. In 186 of the 252 areas with comparable data, the share increased.

If this trend continues, Americans working from home will soon overtake the share of people who use public transportation, as it already has in many regions. The slow but steady shift carries numerous potential implications for transportation systems.

Even Smaller Cities are Not Immune

Once booming Redwood City, a tech-powered city located on the peninsula between San Francisco and San Jose (TheDailyJournal) is already looking at spending freezes, including for critical police and fire services:

With tax revenue weighed down by the pandemic while the need for community resources is increasing, the Redwood City Council will be asked to approve an updated fiscal year 2020-21 budget reflecting cuts and freezes to various services — including the fire and police department.

Cascading Effects

A shrinking tax base can increase the social welfare demands on cities and escalate problems just as budgets shrink. This pattern has appeared many times in the US, from the ghost towns of the West to the boom and bust cities of the Industrial Era (see Rust Belt, for example).

A recent LA Times Op-Ed explains the particular troubles facing California, with a state government increasingly dependent upon stock options for balancing its budget (IPOs) as it witnesses a steady stream of departures (of companies and higher income earners) and looks to an influx of lower income workers in an attempt to offset increasing revenue loss.

These remote first impacts could make it more difficult to recruit employees to your HQs if they are in the wrong cities.

Now let’s look at the productivity challenges facing network/help desk teams and remote employees. The Yellow Brick Road has a few issues, including observability and security.

Remote First and New Organizational Demands: IT and CYA

The effects of remote first extend deep into the financial, tech and services companies already participating before the pandemic. They’ve just been accelerated.

Former Wall Street analyst Gabe Lowy recently advised that IT is entering a strategic “CYA age” driven by an explosion in observability and security demands. These trends were already underway, but the pandemic has accelerated the priority of user experience observability over other initiatives.

The key challenge facing organizations: how they scale their networks to support remote workers when their most widely deployed tools are increasingly blind to the user experience… in more complex home office environments.

He also predicted the cost of downtime will be revised upward in the near future as the remote first network becomes more complex… and more strategic to organization growth, productivity and profitability.

Unintended Remote Worker Consequences

We surveyed a range of companies last spring, looking to identify organizations with the most network monitoring pain. We conducted phone interviews between March and June 2020. The most notable correlation was a jump in user complaints just as organizations were implementing remote work initiatives. See Remote Worker Tech Support Costs. It was clear from our research (and inbound calls and trial requests) that support costs were rising significantly enough to have CIOs engaged in early scoping calls.

Monitoring Challenges Shifting to User Experience

Field ITOps support is costlier than HQ support for obvious reasons, as our WFH blog concluded. And many monitoring solutions are blind to the remote user experience, which is more complicated than typical HQ deployments.

Complexity in Paradise

Remote user connectivity and performance usually depends upon a mix of VPNs, ISPs, consumer gear and apps being accessed in various data centers/clouds. And remote workers are not as technically savvy as network or help desk engineers deployed at the HQ.

Remote Network Performance Issues Can be Anywhere

Add in potential travel and/or 3rd party van rolls and you have a recipe for escalating ITOps costs. The network and IT become increasingly strategic to operating results and employee productivity at the time network teams lose visibility and control over remote worker network performance. Hence the relevance of Gabe’s “CYA era” observation.

Digital Experience Becomes a Primary Growth Driver

Gabe made another interesting comment. He sees policymakers expanding their view of infrastructure from roads, bridges to digital as digital access becomes as important to resident income as physical access. That, of course, takes us into the convergence of IoT and IIoT and even greater observability and security demands coinciding with the diffusion of access.

The Very Nature of Work is Changed Yet Dependent Upon Network Performance

Physical location becomes a secondary consideration (to network performance and bandwidth) as digital access spreads. Digital access to work is now managed by network teams with limited visibility into potential congestion issues.

Organizations that don’t understand the importance of remote user network performance visibility and culture will underperform organizations who shift to remote first and figure out how to further increase productivity.

Got Speed? Digital Winners and Losers

It is obvious the era of the digital nomad (#WFA- or work from anywhere) is here and transformative with boosts in productivity, operating advantages, access to skills and new commute-free lifestyles. Some new boom towns (digital lifestyle hubs) will emerge in areas with great internet and remarkable lifestyle possibilities.

There will likely be a similar impact on organizations. Those first to figure out how to turn their enhanced access to skilled labor deployed in more desirable locations into more productive operating models (Got Speed?) will outperform peer companies still trapped in outdated, higher cost operating models, expensive office space and skilled workers stuck in traffic on roadways or the network. They will have superior observability and security, regardless of where their network and help desk teams and employees are located.